The Case for Investing in

Gold Today

IF YOU'RE LOOKING to store wealth in something both rare and secure today, you will find nothing to match

gold.

Gold always tends to reward cautious savers in times of financial stress, because it is both hard to destroy and tightly supplied.

In short, it is the very opposite of debt.

Gold doesn't corrode or tarnish, and it's relatively useless to industry. That's why almost all of the entire stock of gold mined over the last

4,000 years remains unused today. It exists as either jewelry or bullion, both of which act to store wealth and value.

The world's total store of gold now stands near

160,000 tonnes. But the metal is so dense that, if formed into a single a cube, it would have an edge barely

22 yards in length.

That wouldn't even cover a tennis court!

Gold vs. Paper-Money Inflation

New

gold is being found and mined today at the rate of some

2,600 tonnes per annum.

That's a modest increase of

1.6% per year to the above-ground supply. And critically for the value of

gold, this annual growth-rate lies beyond the power of politicians or investment banks to increase.

The supply of Euros, in contrast — the most hawkishly-managed major world currency right now — is currently expanding by

11.5% per year.

Thanks to this tight supply, gold grew its purchasing power more than nine times over during the 1970s — the last worldwide surge in inflation. In terms of business assets, it rose 23 times over by the start of

1980 as measured against the

Dow Jones Industrial Average.

During the financial collapse of the

1930s — but this time amid a deflation caused by half of all banks in the United States failing —

gold bought

17 times as many financial assets as it did before the Great Crash of

1929.

Now debt defaults and inflation are working together today, forcing a fresh crisis in the value of money.

Gold has already risen three-fold against the New York stock market since early

2000. It's recently turned higher in terms of residential and commercial real estate, too.

Time to Buy Gold?

Gold

Gold doesn't care whether a financial collapse destroys the value of money (inflation) or the value of debt (deflation). Its unique characteristics — indestructibility and tight supply — mean its owners can thrive amid either.

But that doesn't make

gold a "forever" investment.

Gold will always lose value during stable periods of strong economic growth.

Over the twenty years to

2000, for example,

gold lost

95% of its value in terms of US real estate. So it's no surprise that, as a proportion of world investment portfolios,

gold fell from around 2% to effectively zero.

The trend in

gold prices finally turned higher at the start of this decade, just as Gordon Brown — now the British prime minister — sold half the UK's national

gold reserves at less than $

300 an ounce.

Since then

gold has trebled and more. But this gain remains small in the context of previous

gold trends. It's also been limited by Western governments persuading their citizens that "core" inflation in the cost of living is running at just

2% per year or below.

These official

CPI figures, of course, exclude the cost of housing, mortgages, taxes, fuel and saving for retirement. But this trick cannot go un-noticed forever.

New Investment in Gold

New

gold investment will continue to grow if the world's major currencies —

gold's main competition as a store of value — plunge into the inflationary spiral that many economists fear.

Until there's a dramatic change in monetary policy, the over-supply of Dollars, Euros and Yen look set to keep pushing

gold prices higher. And it took a dramatic change in central-bank policy to finally kill gold's last inflation-led surge.

At the start of the

1980s, the Federal Reserve pushed US interest rates up to

18% and above, restoring the world's confidence in its currency and kick-starting the "long boom" of the next

20 years.

Could America survive such strong medicine now? Would Ben Bernanke even dare risk it?

If you think the world's central bankers are about to set interest rates far above the real rate of inflation, you should steer well clear of

gold.

But if you fear for your savings — and you want to start investing in

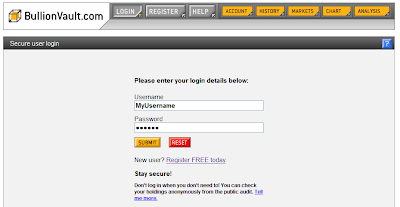

gold — you can start today, for free, at BullionVault.

PLEASE NOTE: We will receive a small referral commission for any accounts opened through this article. But the tiny dealing fees and storage charge you will pay would be no smaller without it.

And this ground-breaking service really does give you unique access to live

gold market prices, cutting out the middleman and slashing the costs of investing in

gold "dramatically" as the Financial Times recently noted.

To find out for yourself, go to

BullionVault - Buy Gold Online now.